Online Line of Credit

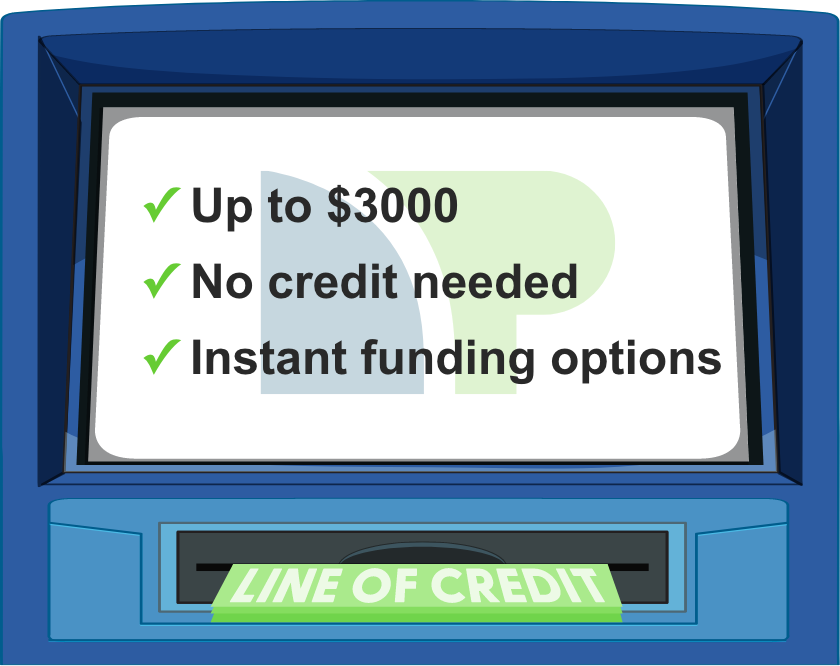

Apply for an online line of credit with Net Pay Advance – up to $3,000. Get a quick decision in seconds. Same-day funding available!

Where are you located?

What is a personal line of credit?

What is a

personal line of credit?

An online line of credit, or online credit line, empowers you to manage your finances on your terms. Whether it’s unexpected expenses, emergencies, or security, it’s your financial safety net. Discover the freedom of a revolving line of credit today.

Fast application. Get an instant decision.

Payday Loans vs Line of Credit

Payday Loans

vs Line of Credit

A line of credit offers a modern and flexible alternative to traditional payday loans. With a line of credit, you can access funds when you need them, up to your credit limit, without the hassle of repeatedly applying for an additional fast cash advance. It’s a faster and more flexible solution, allowing you to borrow only what you need. Plus, you can access your line of credit anytime, giving you greater control over your finances. An online line of credit combines the best features of traditional payday loans and credit cards.

✓ No hard credit check and no credit score requirements.

✓ Repayments scheduled around your payday schedule.

✓ Use your funds as you see fit. ✓ 5-star support service available.

✓ Use your funds as you see fit.

✓ 5-star support service available.

✓ Repay your loan in full, partially, or just make minimum payments on your due date.

✓ Draw from your funds at any time as long as your payments are up to date.

✓ Instant deposit is available for draws. ✓ Only borrow what you need.

✓ Instant deposit is available for draws.

✓ Only borrow what you need.

Line of credit features

Why thousands recommend

Why thousands recommend

For the last 16 years, Net Pay Advance has been serving customers by offering them short-term loans with no credit needed. We cater to our customers with due diligence and provide financial relief when times are tough. We’ve got quite a bit more to offer. Here are just a few out of the countless reasons people recommend us.

At Net Pay Advance, we prioritize YOU – the customer, by offering quick access to cash. We empower you by providing cash assistance with no credit needed so that you can meet unexpected expenses.

Join 8,000+ customers that say Net Pay Advance is the best lender.

Join 8,000+ customers that say Net Pay Advance is the best lender.

Frequently Asked Questions

What is a personal line of credit?

A personal line of credit may also be referred to as an online credit line or a revolving line of credit. It is a flexible type of online payday loan that gives you access to funds with a fixed credit limit. At Net Pay Advance, we offer an instant line of credit no credit check barriers. With our no-credit-needed system, this is a viable solution for people in need of an online line of credit for bad credit, good credit, or no credit. With our personal line of credit loan online, you’re able to borrow funds and repay them over a period of time.

You should use credit line loans when you need a higher loan amount, or credit limit, with a less strict repayment timeline. A credit line cash advance like this is designed for meeting unexpected and emergency expenses.

What is the easiest line of credit to get?

An easy line of credit will consist of a few things: a simple application, fast approval, convenient repayment methods, and an excellent customer support team. At Net Pay Advance, you can get an easy line of credit with all of these features. Our line of credit application is fast! With our fast application and instant decision, customers will get line of credit instant approval or denial. There’s no waiting around. That speed may make a line of credit easier to get than some traditional loans. Don’t just take our word for it: read over 8,000 5-star reviews that agree Net Pay Advance makes the borrowing process easy and convenient.

What is the maximum credit limit I can get?

The maximum credit limit for our easy line of credit depends on state regulations. At Net Pay Advance, our maximum line of credit is $3,000. That makes our line of credit an option for emergency and unexpected expenses.

What credit score is needed for a line of credit?

At Net Pay Advance, there is no credit score minimum needed for a line of credit online. We believe people deserve access to financial solutions regardless of credit score. Interestingly, a “no credit check line of credit” doesn’t truly exist. To confirm a customer’s identity, legitimate lenders run a soft credit check that doesn’t impact credit score. The good news though is that you can find an instant line of credit for bad credit, good credit, and no credit here. At Net Pay Advance, we know our customers are more than a credit score.

Is line of credit available immediately when needed?

When approved for a line of credit online loan with Net Pay Advance, you will have access to funds immediately when needed. You will be able to draw funds as necessary and then repay the balance over time. Having a valid debit card on file can provide you with access to instant deposit.

How do you borrow money from your line of credit?

To withdraw funds from your line of credit, go to your account, and select “Request a Draw.” Determine how much you want to withdraw, and click “Confirm.” Funds will be deposited into your account. It’s that simple!

Rates and Terms

For a complete list of our credit line rates and terms, including interest rate and length of loan visit our rates & terms page.

Line of credit

not available in your state?

Line of credit not available in your state?

Worry not! Check out our lineup of online payday loans. Rest assured, these personal loans come with the same great 5-star service, and same day deposit is available.

Single-Pay Payday Loan

Get immediate financial relief with $255 payday loans online same day. Repay this short-term cash advance in full on your next payday. It’s an effective and convenient one-and-done solution.

Installment Loan Online

Get the cash you need with more time to repay. Our installment loan allows you to pay back the amount you borrowed over several months with fixed monthly payments.

KS Rates & Terms

KS Rates & Terms MO Rates & Terms

MO Rates & Terms UT Rates & Terms

UT Rates & Terms