Installment Loan

Net Pay Advance offers an installment loan product option for Texas residents. You can repay this personal loan in smaller amounts over a 180-day period.

How to get our Texas payday loans online

How to get our Texas payday loans online

Complete our simple and secure online application in minutes.

You’ll get an instant decision on your application.

Approved funds are directly deposited to your account the same day*!

Learn More

Why choose licensed lender Net Pay Advance for Texas payday loans?

Borrowers typically choose us for payday loans online for many reasons. One key benefit is that we provide security and simplicity, making the technology behind our same day loans more trustworthy than most others. As a Texas-licensed lender, Net Pay Advance, has many security processes in place to help protect you from prying eyes. That license means we’re held to higher regulations than other lenders in the market. Not to mention, our payday loans online process is designed to be simple!

Check that your lender is state-licensed:

- See if they showcase their license on their website

- Call them and ask for information about their license

Our payday loans offer high online security

One of the main reasons people borrow with us is our security processes and dedication to our customers’ privacy. We never sell your personal information. Rather, we protect it. We use several processes such as the latest security software to keep data safe. Our staff also undergoes rigorous training periodically to handle information with best practices for security.

On the other hand, working with other lenders with less security means you may not know who has access to your information. Your data may even be sent to a fraudulent party! More, you could receive lots of mail that is unsolicited from other companies. They may send you offers that you will not be approved to borrow. It could be confusing to know who you’re actually borrowing from! You don’t have to worry about that with payday loans online from Net Pay Advance. We’re with your through each step of the payday loan process. You can call us any time that you have a question.

We are committed to giving our customers a positive experience with our Texas payday loans online. Our goal is that smart consumers will choose Net Pay Advance for an instant payday loan. With us, our information stays safe, the process is hassle-free, and you get more peace of mind.

We offer same day online installment loans in Texas

Our online loans are one of the fastest ways to get cash. We offer same day loans as well as next-day deposits. With our same day loans, you get your money instantly when you have a valid debit card on file. Alternatively, our quick next-day loans are available for customers without a valid debit card on file.

We are dedicated to providing fast installment loans. All with no hard credit check. We believe in instant solutions for our Texas customers and we’re here to make that happen. Read more about our fast cash advance solutions. Apply for online payday loans today.

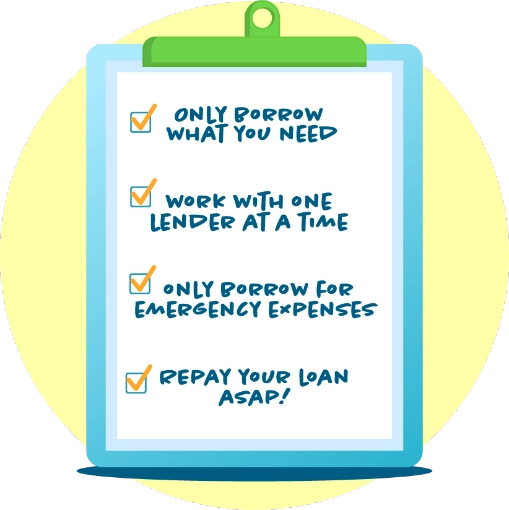

Smart practices for payday loans in Texas

Did you know that almost 12 million Americans choose to take out a personal loan every year? For some people, getting an instant payday loan may be the only choice for their situation. We provide payday loans online with no hard credit check. This makes our same day loans convenient. Nonetheless, customers should follow good loan practices. Here are a few practices that we recommend:

- Apply for only the funds you need to cover an emergency expense. It can be hard to turn down extra cash, but only taking what you need can help keep expenses down.

- Work with just one payday lender at a time. This will help you avoid snowball debt or debt cycles.

- Use online payday loans for emergency expenses only.

- Repay your loan as soon as possible.

Repaying your Texas payday loan

Making repayments as soon as possible is considered one of the best practices for payday loans online customers. This will keep expenses down by avoiding late fees. At Net Pay Advance, we are here to help our customers at every stage of their journey. If you realize that you will not have funds in time to make your repayment, you can extend your due date by 5 days for free! If you need more than 5 days, we offer a Promise-to-Pay (PTP) plan. The PTP plan allows you to break up the payment into smaller, more manageable amounts. Learn more about your options here.

At Net Pay Advance, we’re all about helping our customers make the most of their time and money. That’s why we built a rewards program. When you borrow with us, you can earn rewards that will save you money on payday loans in the future. It’s our way of giving back to customers.

Our free rewards program is easy to use. Complete tasks, earn points, and redeem them for awesome discounts! Does that sound like something you could use? It’s just one of our many customer benefits. Check out our rewards program and apply for your online payday loan Texas today.

Frequently Asked Questions

No hard credit check

No hard credit check