What you need to apply for a payday loan

18+ years of age

Address in state we service

Active bank account

Which payday loan best suits you?

Explore the payday loans we offer and find the one that’s right for your needs. The application process takes only a few minutes. You’ll have an instant decision the same day.

Single-Pay Payday Loan

A single-pay payday loan is a small paycheck advance that is paid back in one sum on your next payday.

Installment Loan Online

An installment loan allows you to make small, fixed payments typically over 180 days.

Online Line of Credit

A line of credit is like a credit card: withdraw from your credit limit and repay over time.

A single-pay payday loan is a small paycheck advance that is paid back in one sum on your next payday.

Payday loans FAQ

Have questions about payday loans? We have you covered.

How do payday loans work online?

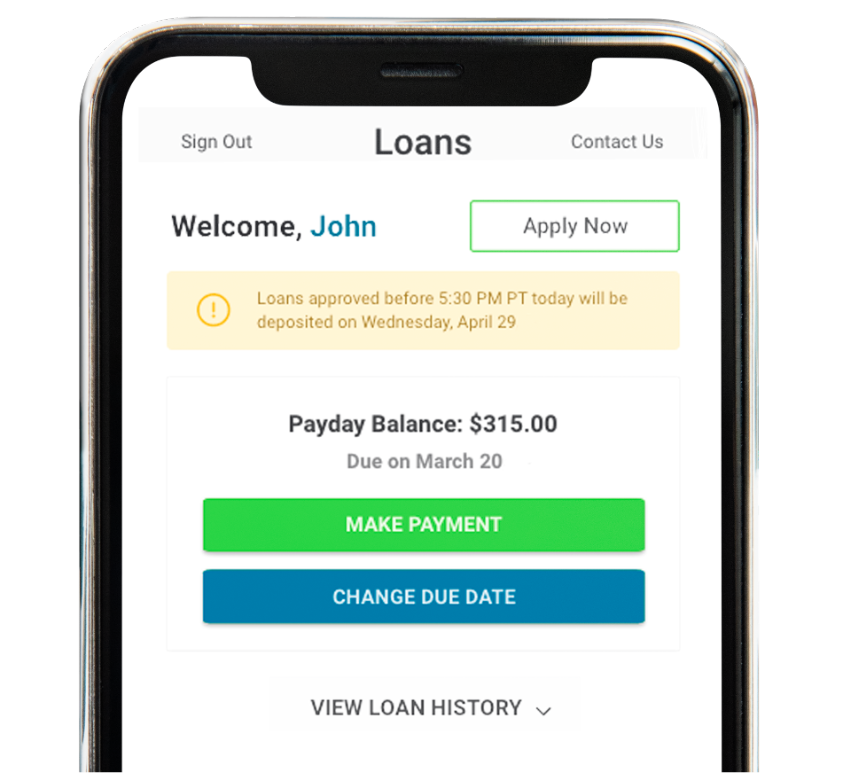

Payday loans online work the same way as store-front payday loans, except everything is digital. Since Net Pay Advance operates exclusively online, customers complete their application online and can manage their loan from our website or our mobile app! Approved funds are directly deposited to your checking account for you to use how you wish. Need some additional assistance? Our world-class customer service team is here to serve you at 888-942-3320.

What are the best payday loans?

The best payday loans are ones that help assist with an emergency need and are repaid quickly, helping the consumer avoid higher fees. Net Pay Advance is committed to creating a transparent product that is easy to understand, can be easily managed and paid off.

What payday loans are easy to get?

We think that the easiest payday loans to get are the ones where you don’t have to leave your couch. Our easy application can be completed in minutes, and there’s no hard credit check. Instant funding means you could have your funds quickly after! Login to your customer portal 24/7 to view your loan details and make a payment.

Where can I get payday loans?

Net Pay Advance offers payday loans online to residents of multiple states where we are licensed to operate. Check our list of state licenses here. If you’re in an eligible location, you can apply directly from your phone by clicking the apply now button above.

Who does payday loans near me?

Net Pay Advance may not have a physical store near you, but we are always in the palm of your hand. Apply online or through our mobile app 24/7. Our instant funding program has no time or holiday hour limitations, so approved funds could be in your account in less than 5 minutes!

How to apply for loans online?

Apply for online loans through the Net Pay Advance website or the Net Pay Advance mobile app. Single-pay loans, installment loans, and lines of credit are available depending on your state of residency. Applicants must be over the age of 18, have a valid ID, active checking account and cannot be a member of the military.

What do I need in order to apply?

You must live in a state where we are licensed to operate, be at least 18 years old, have an email address, and have a bank account in your name that’s been open and active for at least 30 days.

What types of income do you accept?

We accept paychecks as well as Social Security, Retirement, and Pension!

How can I get a no credit check loan?

Contrary to popular belief, payday loans often have a soft credit check. Saying something is a “no credit check loan” isn’t quite accurate. Instead, payday lenders may do a soft credit pull. This pull is common and doesn’t impact your credit score. Net Pay Advance does a soft pull to confirm identity. Your score isn’t part of our decision-making process though. We know you’re more than just a credit score. We offer loans regardless of credit.

How do I get my money?

Getting paid is easy with Net Pay Advance. Fill out our simple and secure online loan application in minutes, and receive a qualified offer instantly. Our no hassle same-day payday loans require two things: an application and online signature. Once you sign, we take care of the rest. Within minutes, we transfer money to your account via same-day direct deposit. Our streamlined process is all online, made simple to keep you moving forward.

How soon do I get my money?

With an eligible debit card, funds will be deposited to your checking in minutes of signing your loan agreement. You get the money you need quickly and without delay, so you can cover the expenses you need and enjoy life uninterrupted. If an account cannot accept same-day deposit, funds will be deposited the next day via ACH. We put money in your hands, when you need it.

How to get quick loans online?

Quick is great, but instant is better! Net Pay Advance now offers instant funding to both new and return customers! All customers are eligible, but require a valid debit card on file to facilitate instant funding. If your debit card doesn’t validate, we fund your checking account the next business day via ACH.

How safe is Net Pay Advance?

We understand your concern. At Net Pay Advance we take your personal and financial safety seriously. We use the latest security software and carefully handle all private information. We also provide info on how to keep yourself safe from scam and fraud as well as an article on what to do if you ever find yourself a victim of fraud or identity theft.

Who does payday loans?

Net Pay Advance may not have a physical store near you, but we are always in the palm of your hand. Apply online or through our mobile app 24/7. Our instant funding program has no time or holiday hour limitations, so approved funds could be in your account in less than 5 minutes!

Where to get loans online?

Net Pay Advance is your place for online payday loans in states across the US. We currently offer single pay loans, installment loans, and line of credit loans. Apply online through our website or mobile app 24/7. Instant funding is available for new and returning customers with an eligible debit card!

Real Customers, Real Reviews

Net Pay Advance is one of the highest ranked online short-term lenders on

We are rated 4.8 / 5 based on over 8,000 reviews.

Thank you so much for the great service…

Thank you so much for the great service and quality service

Gerald

Your payday loans one tap away

Believe it or not, managing your online payday loan is even easier with the app. View your important documents, track your discount points, and more!

Your loans one tap away

Believe it or not, managing your online payday loan is even easier with the app. View your important documents, track your discount points, and more!