It’s because we could all use some quick money in times of crisis!

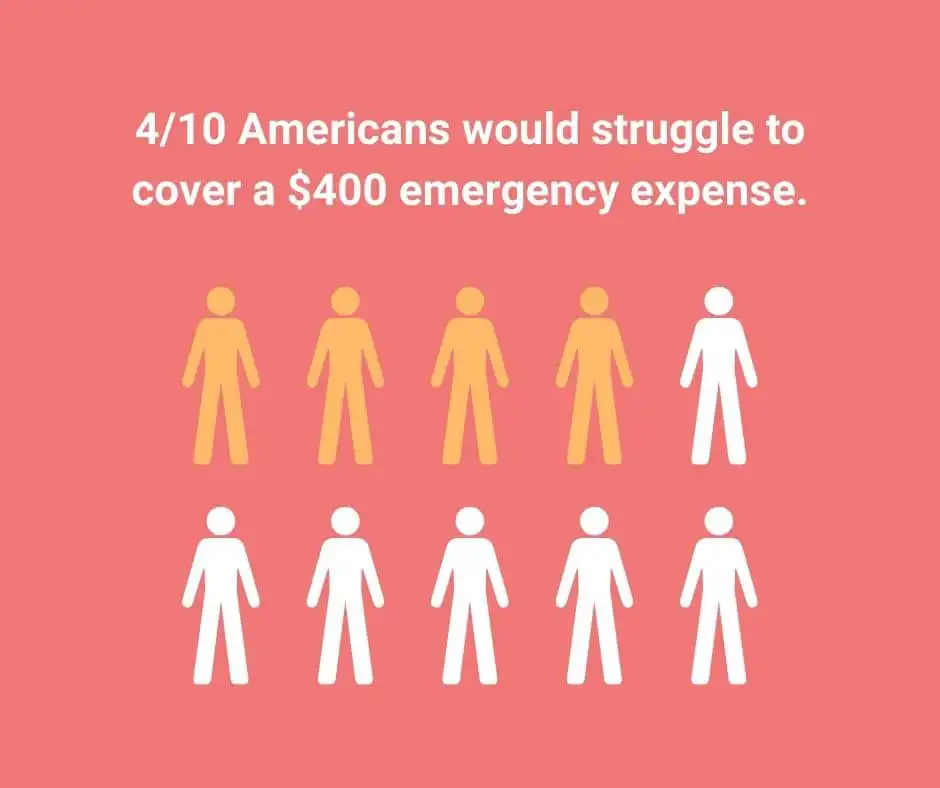

It runs deeper than that. A lot of Americans struggle to pay their bills every month. They have very little room to tackle an unexpected expense. Emergency funds offer a safety net to handle what life throws at you.

Research suggests that 54% of American consumers are living paycheck-to-paycheck. Millennials are found to be the largest group to be stuck in this cycle. The older millennials have experienced two recessions, and are likely to have student debt. Plus, having children increases the possibility of living paycheck-to-paycheck. As a majority of Americans are burdened with financial woes, it is prudent to have some emergency money.

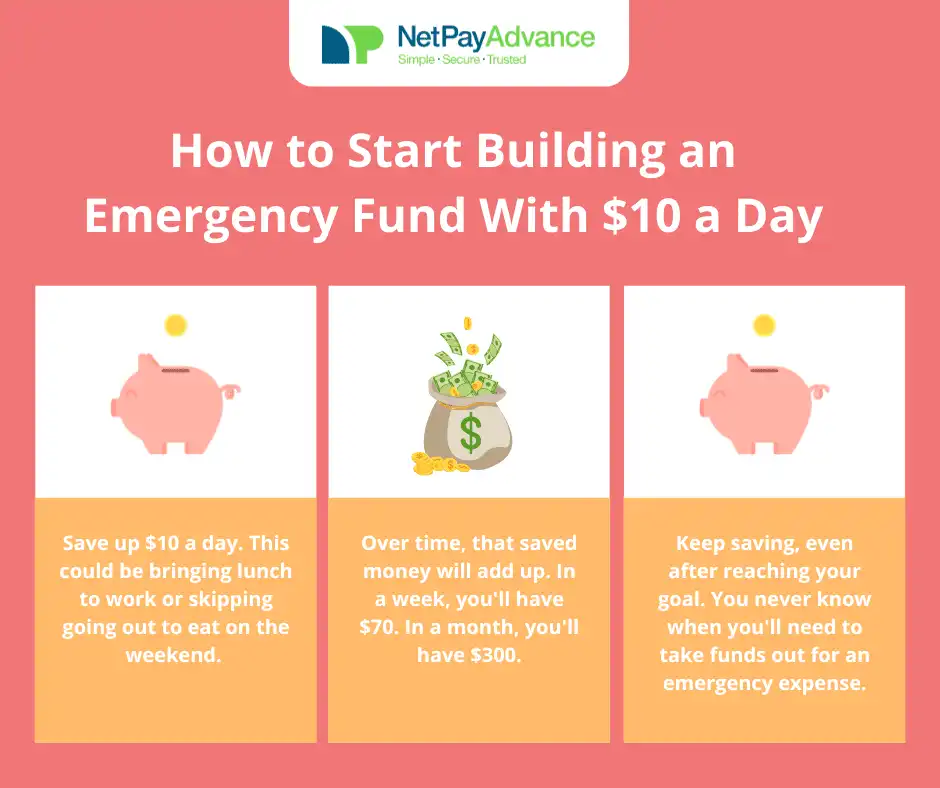

First things first, you can always start small. Even a dollar a day amounts to $365 in a year! Having a few hundred dollars saved up can help get you out of a difficult situation.

If I save a dollar a day, how much would I save?

Use our savings calculator below to see how long you’d have save money to reach your goal!

Pro tip: The more money you save in a day, the faster you’ll build your emergency fund. The faster you save up emergency funds, the better use they’ll be to you.

Pro tip: If you can save up $10 a day, you’ll save $300 in a month. That’s equivalent to skipping going out for lunch, and packing one instead.

Why do you need emergency funds?

Being in a financial crisis isn’t unheard of in the real world. We’ve all either been there or know someone who has. Preparing for an unforeseen expense can be one of the best things you do for yourself. Emergency funds help you tackle life’s curveballs like:

- Medical emergency

- Veterinarian bill

- Car trouble

- Unemployment

- Home repairs

- Last minute travel expense

The pandemic caused major layoffs in various sectors and a lot of us can relate to that. Emergency money helps you get by if faced with an expense you didn’t budget for or you’re facing a loss of income. For the average American, unpaid bills can seriously affect your financial health.

The benefits of having emergency funds:

It helps with anxiety and stress.

As human beings, we are all prone to having moments of anxiety. Some of us suffer more than others. Although there are ways to handle your anxiety, a solution to your financial problems can help lower your stress.

Mental health is a serious concern plaguing millions of people. Small things can have great impact and setting up an emergency fund can help alleviate some of the stress and anxiety. Financial anxiety is real and can have serious consequences. Building up some rainy-day savings is good for your mental health. Expenses you didn’t see coming won’t rile you up as much if you have a financial cushion. You will be prepared to shell out the extra dollars to take care of the situation.

Keeps you from overspending.

Nobody likes bills but there’s no way out of them. We have to pay rent or mortgage, utilities, food, childcare, gas, and more. After setting aside money for your expenses, we recommend contributing towards an emergency fund. You know your income and your expenses along with how much you’re putting aside for emergencies. This lowers the spending money you’re left with and can be a motivation to curb impulse buying.

Helps you get caught up with your expenses.

Your budget ensures that your regular bills are paid on time. Emergency funds take care of the unexpected bills. When you have both a budget and an emergency fund in place, you’re unlikely to have unpaid bills. Sometimes you’ll have a rough month with bumps along the way. An emergency fund will help you cover those while you’re still able to pay your essential bills. This will help you avoid late fees, fines, and penalties.

Prevents you from making hasty financial decisions.

They say desperate times call for desperate measures, but it doesn’t have to be that way when it comes to your finances. We recommend emergency funds because they keep you from acting out of desperation. It is understandable that we might be willing to do whatever it takes to solve a financial issue. An emergency fund ensures we don’t commit financial blunders because we needed quick money to make ends meet.

How to Build a Fund to Handle Emergency Expenses:

You can start building your emergency fund in a few practical steps. They are as follows:

Set realistic goals

This is extremely important. When your goals seem too far away, you’re more likely to give up on them. The key is to set achievable goals. For instance, saving $500 a week is far from practical for most of us. A more realistic target would be to save $50 a month or anything that you can afford.

Start small. It is advised to gradually increase the amount you’re setting aside for your emergency fund.

Budgeting for the win!

Having a budget is at the core of managing your expenses as an adult. We can help you get started with budgeting as beginners. Once you set a monthly budget, you can identify how much you can contribute towards your emergency fund. There are apps designed to help you create and stick to a budget. You will see the areas that you can cut back on and manage spending.

A direct deposit can be helpful

Setting up a direct deposit is a smart way to help build your emergency fund. Talk with your employer to see what options they have. Most employers allow you to split up your direct deposit paycheck among multiple accounts.

Set up a separate account solely for your rainy-day savings. From there, ask your employer to deduct a certain amount from your paycheck and transfer it to a separate account automatically. This system will help you stay on track when temptations try to sway you from your goal.

Out of sight, out of mind.

Save the extras

There are times when you receive money quite unexpectedly. Tax refunds, winning cash money at a contest, inheritance, cash gifts etc. all fall in this category. Instead of spending it on trivial stuff, we recommend putting it in your emergency fund. Of course, you can spend gift money on fun things but it’s wise to do so once you have saved up for your emergency fund. If you’ve met your goal for your emergency fund, any extras that come your way can be spent as you please.

Emergency fund alternatives you need to avoid:

Not having rainy day savings can let an emergency wreak havoc on your finances. People are known to make poor financial decisions when in a crisis. We have listed a few alternatives to avoid as well:

Credit cards:

Some people use credit cards for everything including emergency expenses. Taking out a new credit card or using a credit card for unexpected bills means you’ll be deeper in debt. With interest, you’ll most likely owe a lot of money. Worst of all, this can hurt your credit.

Retirement accounts:

Some people resort to withdrawing money from their retirement accounts when under pressure. We advise against doing so. If you’re dipping into your 401k or a traditional IRA, you’re likely to face a 10% penalty. In addition to that, withdrawing from your retirement account pushes you away from your retirement goals.

Money in bonds or stocks

There are people who play around with stocks or have bond investments. They’re a great way to make some money but not something to rely on during an emergency. The stock market can be volatile. Selling your shares when you need to might cause you to take a loss instead of selling them when the market is right.

Friends and family.

Some of us are blessed to have an amazing friends-family support system. They are there in times of need and when you need a little help. However, it isn’t the best idea to rely on them every time life is hard. They could be struggling with their own issues. In addition, money often complicates relationships. Being self-sufficient with an emergency fund will help you avoid awkward conversations with your loved ones.

Prepare for the unexpected

Nothing can help you through a crisis like preparation. They say a stitch in time saves nine and we stand by it. Having some rainy-day savings not only helps you financially, but it also brings peace of mind. Emergency money can help cushion the blow when you’re hit with a massive bill. No matter what your financial situation is, being armed for the worst is always your best defense.

Relying on insurance isn’t always a safe bet. People are often stuck with enormous bills even after insurance. Having a back-up in the form of emergency money can drastically change your situation. We hope our take on emergency funds can help you get started towards building yours. When life throws lemons, enjoy a glass of lemonade and a slice of lemon meringue pie!