Everything you need to know about Instacart taxes

An unavoidable element of adult life is taxes. Whether you work for an employer or are self-employed, we are all required to pay income tax. As an Instacart shopper, you need to figure out your taxes and I’m here to help you get started. Let’s talk about Instacart taxes.

Taxes, am I right? I don’t think I’ve met a single person who likes doing their taxes. As inconvenient as they are, they need to get filed. You want to pay your taxes on time to avoid unwanted consequences like fines.

Never stress about an unexpected expense again.

People start driving for Instacart for all kinds of reasons. For me, it was the fact that I wasn’t doing much in the evenings and decided to monetize my time. Another person might have picked it up due to the flexibility of the job. Once you are an Instacart shopper, you start making an income on which you owe taxes.

Instacart proved to be a much-needed service during the pandemic. Prior to Covid-19, Instacart had yet to turn a profit. April 2020 was the first profitable month for Instacart at $10 million. With market signs that the company did well in 2020, it’s expected that Instacart shoppers made decent money as well.

Topics covered in this piece:

Making money with side gigs is great! Alas, if you make money, you owe taxes. If you work for Instacart, you are an Instacart independent contractor and have to pay your taxes on your own. It’s similar to services such as:

You owe taxes on the income you make while working for these companies.

How much do Instacart shoppers make?

Instacart shoppers earn an estimate of $5 per delivery batch and $7-10 for every full-service batch. Full-service means shopping and delivering. These shoppers often earn tips when they’re delivering to customers.

In-store shoppers receive an hourly wage which depends on the location. Earnings depend on elements like number of items, distance driven, type of products, size of an order etc. Sundays and days with special events like the Super Bowl tend to have higher demand and hence bring more money.

With the money you’re making – both income and tips – you’ll need to pay taxes on it.

How much to set aside for taxes?

We recommend setting aside 25-30% of each payment for tax purposes.

Instacart taxes explained

As an Instacart shopper, you’ll need to pay a few different types of taxes. They are:

Self-employment tax

When you work for Instacart as a shopper, you are considered to be self-employed. As such, you are required to pay self-employment taxes. The tax rate for self-employment is 15.3%, out of which 12.4% goes towards Social Security tax and 2.9% accounts for Medicare tax.

State tax

Except a few U.S. states, residents in most states are required to pay state income tax. It varies by state and income. Your tax bracket depends on your entire income, and not just on what you make from Instacart. We recommend accounting for state income tax so that you’re prepared for when it’s time to pay.

Federal tax

In addition to state and self-employment taxes, you also have to pay federal income taxes. It varies by the bracket which depends on your income. You need to consider quarterly taxes and year-end taxes when paying federal taxes.

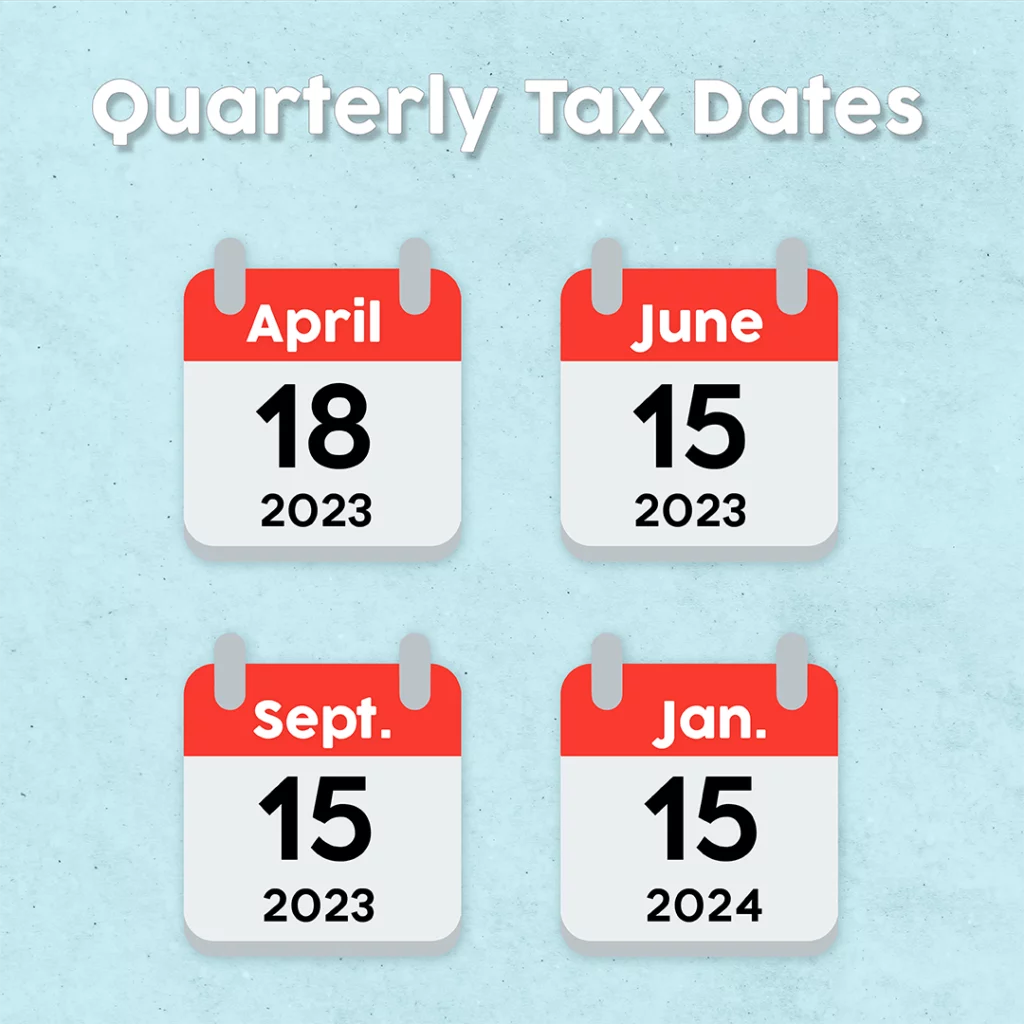

There are a few important deadlines to be aware of to pay your taxes on time. Paying quarterly taxes can help avoid penalties and also helps you understand your cash flow better.

Need help covering expenses after setting back money for taxes? We can help you with an installment loan or line of credit loan.

When are Instacart taxes due?

If you earn at least $1,000 in a year, you’ll need to pay quarterly self-employment taxes. The following are the dates you need to look out for when filing taxes.

Instacart tax deductions

A major benefit of being self-employed is being able to deduct business expenses from your income! This means that when you file Instacart taxes, you get to deduct some of your work-related expenses. These expenses stem from purchases that are necessary to run your business. If you forget to account for your business expenses, you’ll end up overpaying. We suggest keeping a record of all expenses incurred over the course of the year.

The principal tax deductions for Instacart shoppers are:

Mileage

You can claim mileage while driving for work such as when picking up and delivering orders, in between deliveries, and driving to the gas station or maintenance shop. Please bear in mind that your mileage at the beginning and end of work when you commute from and to your home is not deductible.

There are two ways to deduct mileage and you can pick either one.

The Standard IRS Mileage Deduction lets you deduct 65.5 cents/mile (for 2023). In 2022, the rate was 58.5 cents/mile. This is usually the best option for Instacart shoppers as this one standard rate covers costs like gas, depreciation, repairs, and maintenance.

The second approach is the Actual Expenses Method. You can add and deduct every business expense related to your vehicle. This method proves to be beneficial for those who drive a vehicle purchased in the previous year or are making monthly payments on a new vehicle.

Does Instacart track mileage for taxes?

Instacart considers estimated mileage when calculating payment for orders. It is not done for mileage deduction or reimbursement on Instacart taxes. We recommend tracking your mileage for better accuracy. You can manually track miles by looking at your car’s odometer after every order. Alternatively, you could use apps to do the same. Gridwise, Stride Tax, and Hurdlr are popular mileage tracking apps.

Phone and phone bills

If you use your phone for business purposes half the time, you could claim half of your phone costs as a business expense. We recommend going through your phone records for any given month. You can estimate how much of your phone’s usage is business related and use it as an average for the rest of the year.

Tolls and parking

Excluding tolls to and from work, you can claim any toll fees paid during work. Keep your receipts on file. Make it a point to review bank and credit card statements. You might be able to access statements for electronic toll collection online. There might be times when you have to pay parking fees for work. These fees are tax-deductible.

You’re responsible for expenses like speeding tickets, parking tickets, traffic violations, etc.

Accessories

This includes items you purchased to facilitate your job. You can claim accessories like insulated bags that keep food warm, car mounts and chargers for your phone, and other similar items. We strongly encourage you to limit these items only for business purposes and not for personal use.

Health insurance

You can claim health insurance as a deductible if you are self-employed full-time with Instacart, have a business profit, and are unable to receive health insurance from your employer or a spouse.

Roadside assistance

A percentage of the fees for roadside assistance programs can be claimed as a business expense. Use your business mileage log to figure out the business to non-business mileage ratio. You can apply this ratio to calculate the deductible portion of your membership fees.

Just divide your business miles driven by the entire amount you’ve driven during the time. Then multiply that amount by your roadside service membership fee.

Let us assume that in the last quarter you drove 5,000 miles, 3,500 of which were for business. Your business to non-business mileage ratio will be 3500/5000 = 0.7

Deductible portion of your roadside assistance membership fee is 0.7 times the membership fee.

What type of employee are you when working for Instacart?

You are an independent contractor or a 1099 employee. It means that as an Instacart shopper, you don’t receive a W2 for tax purposes like traditional employees do.

Does Instacart take out taxes?

No, Instacart does not take out taxes because shoppers working with Instacart are independent contractors.

What are the documents you need to file Instacart taxes?

To file your Instacart taxes, you’ll need tax forms and other documentation. Use our checklists below to ensure you have all the papers you need. With a quarterly tax cycle, tax time is always right around the corner.

Instacart 1099 and other Instacart tax forms

The documents needed to file Instacart taxes are the tax forms like:

- 1099- NEC

- Schedule C

- Schedule SE

- Form 1040

Will I get a 1099 from Instacart?

Yes, you will get a 1099-NEC from Instacart if you earned more than $600 in the previous tax year. You should typically receive it by January 31st of any given year.

What to do if you didn’t receive a 1099-NEC form

If you earned less than $600 in the previous year, you may not receive a 1099 form since Instacart isn’t required you send you one in that case. Not receiving the form from the company doesn’t mean you don’t have to file Instacart taxes. You will have to report your earnings as you’d report cash income.

If you made over $600 in the last year but still didn’t receive your 1099 form, we recommend sending an email to [email protected] and requesting the form.

Other documents you’ll need to file your Instacart taxes

In addition to the Instacart tax forms previously mentioned, you need other general documentation. These documents will prove your identity and listed deductions. It’s good practice to bring information like:

- Your driver’s license

- Social Security Number (SSN) or Taxpayer Identification Number (TIN)

- Receipts and invoices

- Mileage log

- Previous tax statements for referral

What happens if you don’t pay Instacart taxes?

Akin to not paying taxes on any other source of income, you could face penalties if you don’t pay Instacart taxes. You’ll be required to pay a 10-15% late fee for every month your payment is late.

Need help paying your Instacart taxes? We can help with your payments! Learn more about the best loans for gig workers today!

Final thoughts…

Side gigs or hustles have become more mainstream than they were in the past decade. They aren’t unheard of anymore. Several professionals pick up a side hustle to either explore their passions or make extra money. Becoming an Instacart shopper could be a fun gig if you enjoy shopping. The best part is that you get paid to do so. You are helping people gain access to groceries without physically having to be at a store.

Any activity that generates an income is faced with filing taxes. Instacart is no exception. There are several shoppers who make decent money working with Instacart. I hope these insights on Instacart taxes prove to be helpful when tax season is around the corner. Happy Instacarting!

same-day loans.

same-day loans.