Arm yourself with all the information you need to file Uber taxes

Navigating Uber driver taxes can be tricky. Luckily, we did some digging so that you don’t have to. Let us explore the world of Uber tax documents to get you ready for tax season.

With inflation being where it is, who would say no to extra cash? That’s exactly what several rideshare companies offer. A little money on the side to supplement your income. Some people have gone on to make it their full-time gig. Either way, driving for Uber could be a great side hustle for those looking to make some dough.

The best part about having an extra income is all the financial perks it brings. The annoying side to it is that you’ve got to file taxes on the income earned. Who are we kidding? Nobody likes to do their taxes! Okay, there might be a few exceptions, but that is not the general consensus. Filing taxes is one of several tasks we take on as adults. It needs to be done and we’ll show you how.

Along with Uber, there are other similar companies that require you to pay taxes on income. Take a look at our additional tax resources:

We will attempt to answer some popular queries regarding Uber taxes and Uber tax document in this article.

How much do Uber drivers make?

The average Uber Driver makes about $17 per hour in the United States.

The exact pay depends on several variables like location, demand, number of hours worked, tips etc. For instance, Uber drivers in New York City make $26.24 per hour.

Do Uber drivers file taxes?

Yes, Uber drivers have to file and pay taxes.

What type of employee are you when driving for Uber?

You are an independent contractor when driving for Uber. You might also be referred to as a 1099 employee.

Does Uber take out taxes?

No, Uber does not take out taxes from your pay.

As an Uber driver, you are an independent contractor. Unlike an employee that receives a W2, your earnings are reported on 1099 forms.

As an independent contractor, it’s your responsibility to put aside funds to cover your taxes.

What are the Uber tax documents you need to file taxes?

Uber drivers may receive two 1099 forms. To access these forms, log in to your Uber account and click on the “Tax Information” tab. Then click on “Download” button next to your tax forms.

Form 1099-K is a tax document that reports the total amount earned from passengers. It includes Uber commission and other fees. Therefore, the amount reflected on Box 1a of the form will be higher than what you really earned. You are allowed to deduct business expenses so that you only pay taxes on your actual earnings.

In case you received payment in referrals and non-driving related bonuses, you might receive your Form 1099-NEC. This tax document will include information on how much additional money you made from referrals and bonuses. That money must be reported too.

It is to be noted that the IRS does not mandate Uber to send you a 1099-K if you earned less or equal to $20,000 in payments. Same applies if you processed less than 200 transactions. Similarly, Uber is not required to send you a 1099-NEC if your non-driving income was under $600.

In case you do not receive your 1099, you still need to report your income to the IRS. You can file taxes without a 1099. However, you will need to file a Schedule-C to report self-employment income.

Your earnings overview is displayed at the top of the app, and you can swipe to view your weekly and daily earnings. For more details, go to the “Earnings” section on the app.

When are Uber taxes due?

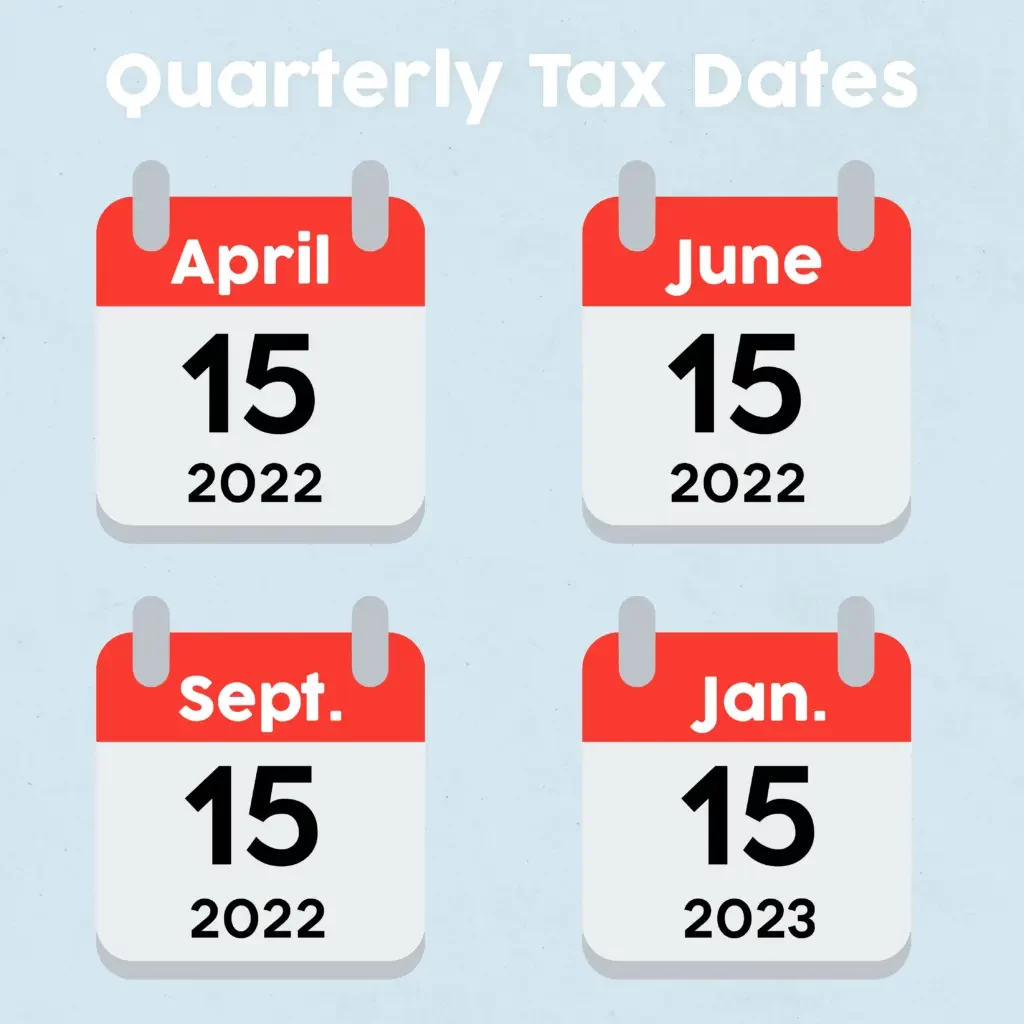

If you drive for Uber, you’ll have to file quarterly taxes. They are due on the following dates:

- April 15th

- June 15th

- September 15th

- January 15th of the following year

The point of paying quarterly taxes is that it often makes your tax payments more manageable.

Uber tax deductions

When it comes to driving for Uber, there are two types of deductions you can claim on your taxes. This is the perk of being an independent contractor. You paid expenses to work, and now you get to save on taxes! You can deduct vehicle expenses and operating expenses. Let’s take a closer look.

Vehicle expenses

This includes the expenses related to driving your car such as mileage, parking, tolls etc.

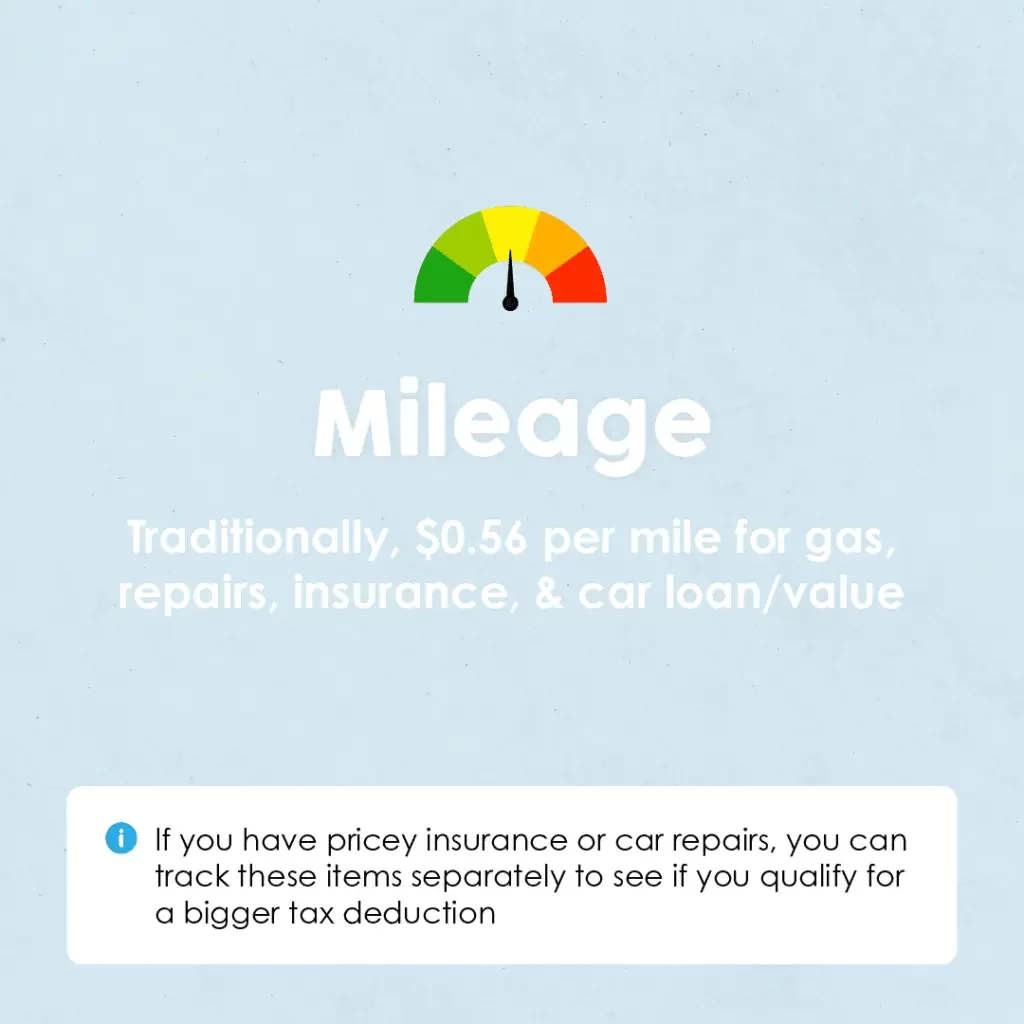

There are two ways to claim mileage deduction:

- Standard mileage: Multiply the standard rate (65.5 cents in 2023) by your business miles. This will be inclusive of driving costs, gas, repair costs, maintenance, and vehicle depreciation. Using the standard mileage is easier and is the more commonly used option. For example, if you drove 200 miles in the last quarter, you will multiply that by the standard rate (200 x .56 = 112) to get the standard mileage.

- Actual expenses: To calculate actual expenses, you will need to track all your driving expenses. We recommend seeking a tax professional’s advice. This method enables you to deduct a percentage of your gas costs, repairs, insurance, depreciation, and other costs. Bear in mind that you will need to have receipts to support your claims. For example, 50% of your total miles were used for Uber and the rest were for personal use. If your car expenses were $10,000, you will need to multiply that by 0.50 (10,000 x 0.50 = 5,000) to get your actual expense.

Operating expenses

This includes other expenses such as Uber fees and commissions, snacks and beverages for passengers, accessories like chargers or cables, mileage tracking software, personal protective equipment (masks, sanitizer etc.), and cost of cell phone plan.

However, you can only deduct the portion of your cellphone bill that you use for driving Uber. For example, assume that use your cellphone exclusively for Uber about 30% of the time. In this scenario, you can deduct 30% of your cellphone bill as an expense.

How much Uber taxes will I owe?

As an Uber driver, you will pay two types of taxes: Self-employment tax and Income tax. We recommend setting aside 25-30% of your net income to cover both kinds of taxes.

Self-employment taxes

Akin to how full-time or W2 employees get a portion of their paychecks taken out for Social Security and Medicare taxes, Uber drivers will need to pay self-employment taxes. If you earned over $400 driving for Uber, you would need to pay about 15.3% of your net income. Note that net income is what you have left after deductions to your earnings.

Income taxes

This boils down to your total income from all sources, tax bracket, filing status, tax deductions, and tax credits. Unlike self-employment taxes, this does not have a universal rate.

Using a professional tax service could be a smart way to go. Turbotax has free options for tax preparation that are worth looking into.

Uber Tax calculator

To get an idea of what your taxes might look like, we suggest trying out our Uber tax calculator. Please know that it may not report accurate numbers. We’re not tax preparing experts, and a lot can be based on your unique work situation. So, we’d recommend speaking with a professional tax preparer for more accurate estimates.

What happens if I can’t pay my Uber taxes?

There are fines and penalties when you don’t pay taxes. Our suggestion is to keep track of tax deadlines to prevent missing payment. Quarterly taxes could help avoid missing your payment as the amount owed in taxes will be smaller than when paying annually.

Always remember, if you find yourself in a situation where you need cash instantly, Net Pay Advance is happy to help. A loan from us could help you avoid penalties. If you have a valid debit card on file, you can get same-day funding. Appy today!

Conclusion

When choosing a side gig, it is best to pick one that offers you the best compensation for your time. You also want some flexibility regarding your hours and schedule. Driving for Uber offers you both! You can earn tips and you get to keep 100% of all tips earned. Uber allows you to set your hours and work when it’s convenient for you.

Not everyone likes driving other people from one place to another. However, if you don’t mind driving and getting paid for it, this might just be the gig for you. We know that understanding taxes or more specifically, Uber taxes can be a challenge. Therefore, we hope this piece was able to provide answers to your queries. Tackle tax season like a pro with our insights!