Discover how the Truth in Lending Act impacts both lenders and borrowers in the United States

There are rules and regulations in place to ensure that certain operations are carried out ethically. This is true for an array of aspects in our daily lives. The Truth in Lending Act is one such stipulation. Let’s dig deeper.

We’re aware that there are some federal as well as state laws that individuals and businesses must follow. These could pertain to human behaviors, land and property matters, social institutions, and more. Sometimes in order to protect people, the federal and state governments issue decrees. The Truth in Lending Act (sometimes incorrectly referred to as the “Truth and Lending Act”) was brought into existence to do the same.

What is the Truth in Lending Act?

The Truth in Lending Act is a federal law that protects consumers in their transactions with creditors and lenders. It requires that information such as annual percentage rate (APR), loan terms, total costs, etc., are disclosed to the borrower before extending credit.

In addition to providing a uniform system for disclosures, the Truth in Lending Act does the following:

- Protects consumers from unethical credit billing and credit card practices

- Empowers consumers with the right to rescission

We asked Carl Maughan, Director of Legal and Compliance at Net Pay Advance Inc. to share his insights. He shared,

“The Truth in Lending Act and its implementing regulations (Regulation Z) are intended, to ensure that consumers receive accurate information about loans in a manner which is clear and meaningful to them so that the consumer can understand the terms of the agreement and readily compare credit terms.”

What must be disclosed in the Truth in Lending Act?

Lenders need to disclose the following information as per the Truth in Lending Act:

- Loan amount

- APR – Annual Percentage Rate

- Application fees, late fees, penalties, etc.

- Payment schedule

- Total repayment amount

Are there any loans or types of debt that fall outside of the Truth in Lending Act regulation?

Yes, there are some types of loans that are exempt from the Truth in Lending Act. In general, the Truth in Lending Act applies to all consumer loans. In the case of business-purpose loans or loans made to entities, the Truth in Lending Act does not apply. Same goes for certain types of student loans.

What is a real-life example of the Truth in Lending Act?

A good example of the Truth in Lending Act being in effect would be seen with credit cards. The Truth in Lending Act can’t dictate what interest rates a bank or credit card company charges their customers. However, it mandates that the bank and credit card company be transparent with their customers regarding the rates, when payments are due, and any penalties for failing to repay.

Where can I access the Truth in Lending Act?

Carl adds, “It requires that certain critical terms of credit are explained and presented to consumers in a uniform manner and format using standardized language, credit terminology and expression of rates. These are normally expressed in a Truth in Lending Act disclosure box.”

Customers that take out a payday loan or installment loan with Net Pay Advance can find the Truth in Lending Act within their loan contract.

Even if you’ve already signed your contract, you can always go back and review your personal loan contract at any time. Net Pay Advance believes in transparency. Our customers can sign into their account and see any past loan documents and contracts.

Here’s how to access your personal loan contract:

- Sign into your account

- Select the “Loans” tab on the left side of your dashboard

- Then click the “View contract” button on the right side of your most recent personal loan.

Log in to your Net Pay Advance account to read more about the Truth in Lending Act.

What is the importance of the Truth in Lending Act?

The Truth in Lending Act helps protect consumers from falling prey to unethical lenders and lending agencies. You can avoid expensive mistakes when you look for a new credit card or loan thanks to the Truth in Lending Act.

In addition, the Truth in Lending Act allows you to back out of a deal within three days of signing a contract. You don’t lose any money if you do so. It is essential to know that if you feel a certain pressure from the lender, you can always walk away within that time frame. We advise you to do your research on the right to rescission when dealing with a lender.

The right to rescission

The right to rescission allows a consumer to cancel a loan within three days of closing. It holds true for home equity loans, line of credit, and refinancing with a new lender. Your right to rescission comes with no questions asked. It is in place to protect consumers from unethical credit practices.

Another essential feature of the Truth in Lending Act is helping a customer look for better rates. The transparency of disclosures enables one to make comparisons. Be sure to consider the rates and terms along with the fees. This will help you compare one lender’s offering with another’s.

What violates the Truth in Lending Act?

If any of the information as mandated by the Truth in Lending Act is not being disclosed to a borrower, it is considered to be a violation.

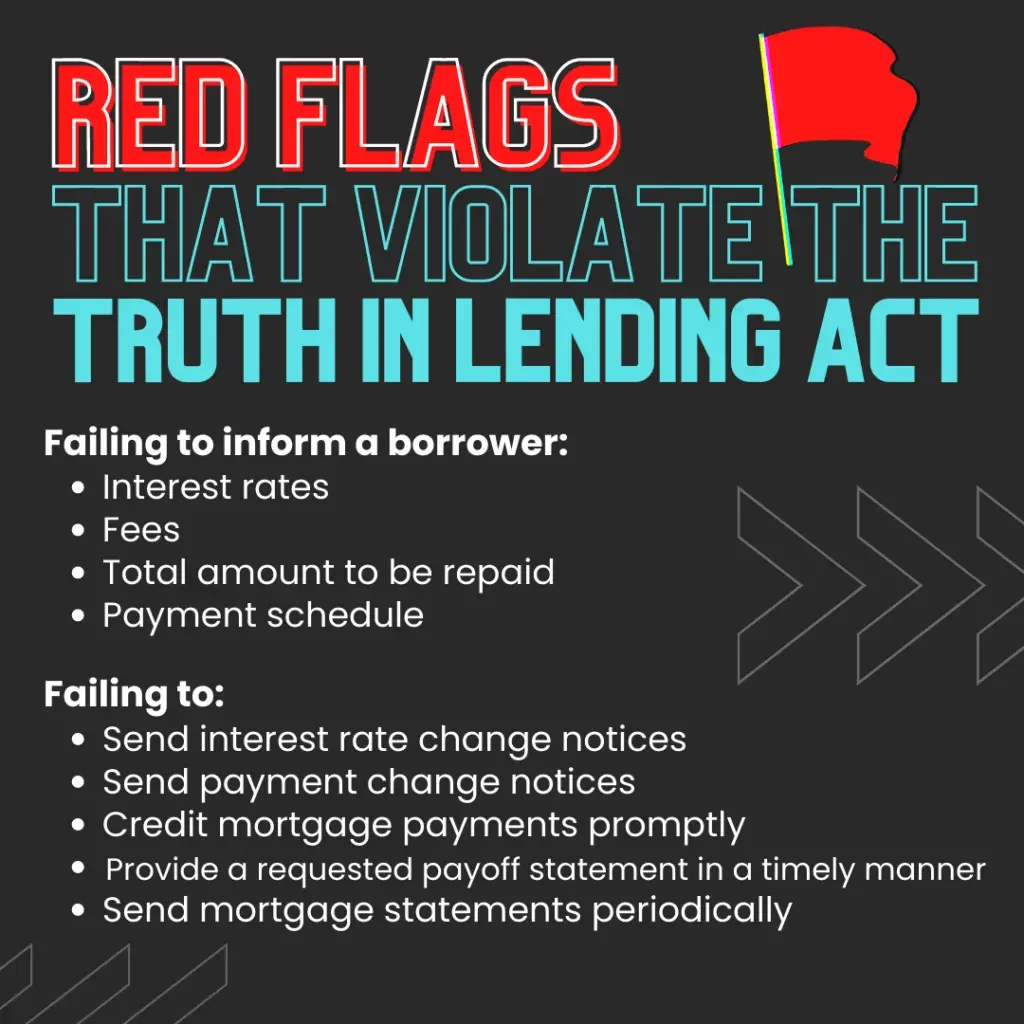

What are some red flags that violate the Truth in Lending Act?

Failure to report details such an interest rate, fees, and other terms of the loan accurately and in accordance with the uniform method laid out in the regulations are some red flags that violate the Truth in Lending Act.

Here are a few things to look out for when considering a loan:

How do you report a Truth in Lending Act violation?

All Truth in Lending Act violation reports should be made to the Federal Consumer Financial Protection Bureau (CFPB) or to the State Attorney General’s office.

Closing Thoughts

As a consumer, we encourage you to be aware of the Truth in Lending Act and how it can benefit you. It was established by the Federal Reserve Board to offer protection to individuals seeking to borrow. We hope our insights help empower you with the knowledge you need as you navigate the world of lending and finances.

For additional information that could be beneficial to you, please consult our resources: