When you make an income, you are required by law to pay taxes. However, it is not always a simple process. There is a lot that goes into tax preparation and we’re here to decipher the intricacies of Postmates taxes. Let’s take a look at Postmates 1099.

It’s a new day with new opportunities! Like a lot of people, I constantly look for gigs to supplement my income. This became more of a thing when the pandemic hit, and our lives changed entirely. I wanted something easy and flexible. I began my search for a side hustle that worked for me.

During my search, I came across a wide range of side hustles ranging in skill and compensation. I think this list of the best side hustles is a great place to start digging.

Covid-19 forced us to stay indoors and give up ordinary pleasures of life like eating at restaurants. Not to be deterred, mankind found excellent alternatives and resorted to using food delivery services. This made me consider working for Postmates as a delivery driver.

When you work for Postmates, you make an income and are therefore required to file taxes. This is just like working for any of the following companies:

In this piece we shall address common queries pertaining to working for Postmates and Postmates taxes.

How much do Postmates drivers make?

Postmates drivers can make up to $25/hour, including tips.

Please note that the amount you can earn working for Postmates varies depending on the area and demand. Some days have a higher demand, and it reflects on your earnings.

Do Postmates drivers file taxes?

Yes, Postmates drivers are required to file and pay taxes.

What type of employee are you when driving for Postmates?

You are an independent contractor or 1099 employee when working for Postmates as a delivery driver.

Does Postmates take out taxes?

No, Postmates does not take out taxes. For those that are working a typical 9-5 job, you likely completed a W2 so that your employer takes out taxes on your behalf each pay period. Alas, Postmates is different. As a Postmates driver, you’re technically an independent contractor. This means that as an independent contractor, or 1099 employee, Postmates has not been taking out your taxes for the year.

Instead of a W4 tax form, you’ll likely be given a Postmates 1099 form.

Does Postmates send you a 1099?

Yes, you will receive a Postmates 1099 from if you earned more than $600 in a tax year.

In case you made less than $600 in the previous year, you may not receive a Postmates 1099. Not receiving your 1099 doesn’t mean you don’t have to file taxes. You will still need to report your earnings to the IRS.

In case you didn’t receive a Postmates 1099 even though you earned over $600, you’ll need to contact Postmates and Uber Fleet Support.

How do Postmates drivers file taxes?

The process to file your taxes doesn’t change much. You can choose to work with a tax preparer professional, or a on your own with an online tax filing software. Some of these services come with a cost. Others are free. Here’s a list of potential free tax filing services.

What are the documents you need to file Postmates taxes?

You’ll need tax forms and other documents to file Postmates taxes. We have a checklist for you below to make sure you know what documents and information you need.

- 1099 form (used to show how much money you made through Postmates)

- Schedule C (used to show how much you made and spent to operate your business)

- Schedule SE (used to calculate the tax due on net earnings from self-employment)

- Form 1040 (Schedule C & Schedule SE are part of Form 1040)

- Expense records

- Mileage log

- Asset information for depreciation

- Previous records of taxes

- Social Security Number (SSN) of Taxpayers Identification Number (TIN)

- Driver’s license

Postmates Tax Deductions

I have good news! Being self-employed allows you to deduct business expenses from your income. So, when you file Postmates taxes, you can deduct some of the necessary expenses incurred to run your business. If you do not claim these expenses, you will be overpaying in taxes, and nobody wants that. Keeping meticulous records of all your business purchases is a smart way to save money in the long run.

The common tax deductions for Postmates are:

- Cost of insurance

- Loan or lease payments on vehicle

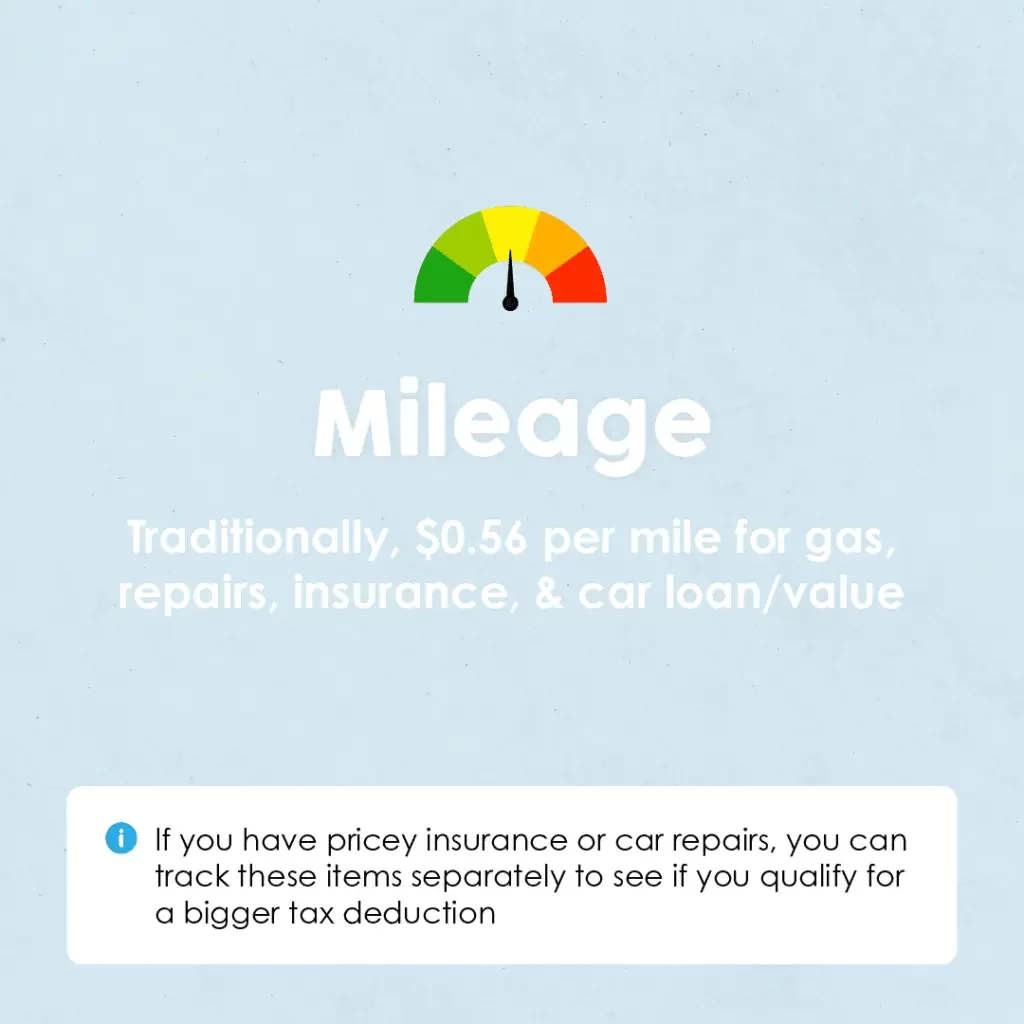

- Mileage

- Parking and toll

- Maintenance of your vehicle

- Hot bags for food delivery

- Postmates commission fees

- Phone and phone bill

You need to be mindful of the fact that you can’t attempt to write off an item entirely if it also serves for personal use. For example, if you use your vehicle for Postmates 50% of the time, then you can deduct only 50% of your insurance, lease, and registration costs. Similarly, if you use your phone for Postmates 30% of the time, you can only deduct 30% of your phone and phone bill costs.

Does Postmates keep track of mileage?

No, Postmates does not track mileage for you. We recommend using the free Stride app from your app store to track mileage and expenses.

One of the most important numbers to track is work mileage. If you forgot to keep track of your mileage in the last year, you have options. Here’s how to calculate your mileage if you weren’t keeping track. Going forward, you’ll want to keep track of how many miles you’re driving for your Postmates job.

When are Postmates taxes due?

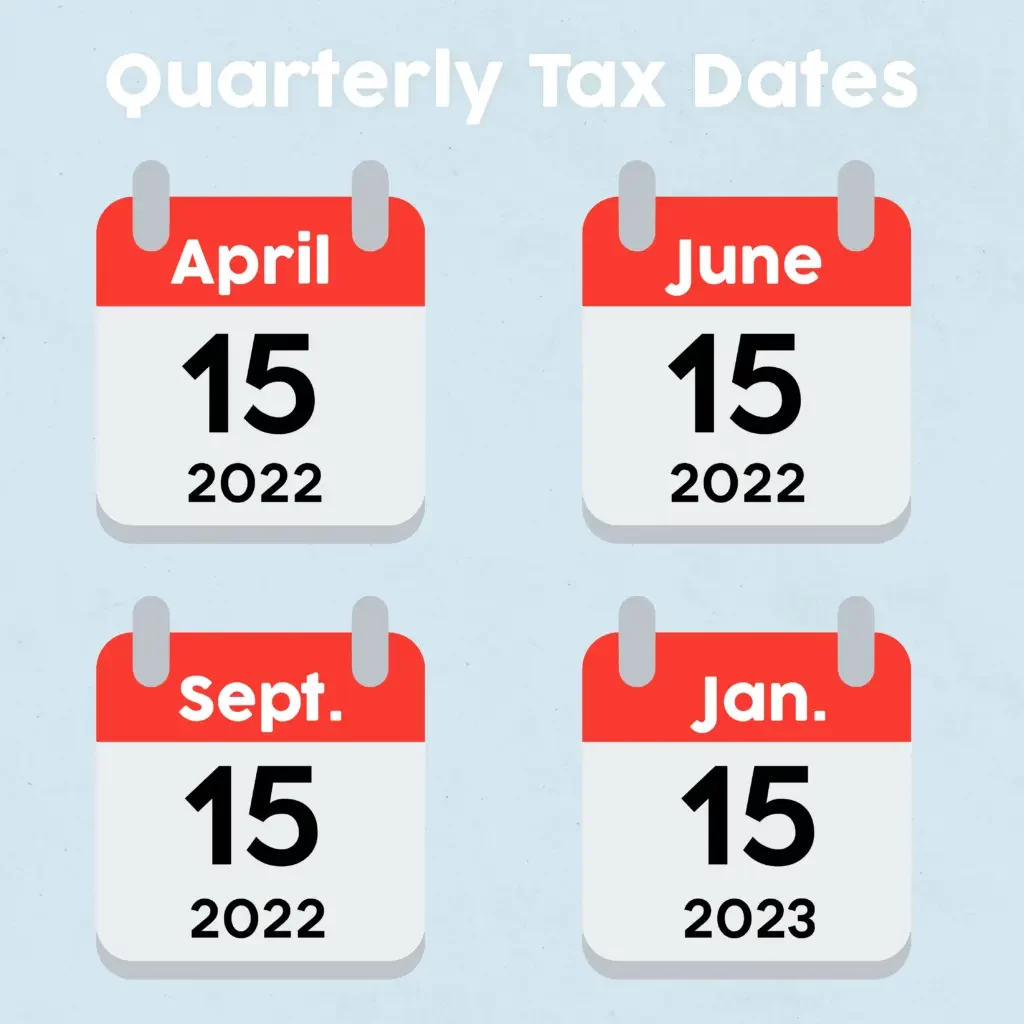

When driving for Postmates, you’ll need to pay quarterly taxes which are due on the following dates:

April 15th

June 15th

September 15th

January 15th of next year

What happens if I don’t pay Postmates taxes?

Not paying taxes can have consequences like fines and penalties. We encourage you to keep track of the deadlines and file your taxes on time. Missing a due date might add up to an extra 25% to your bill.

Paying taxes quarterly will help prevent you from missing your payment. In addition, the taxes owed will be much smaller when paid quarterly, versus all at once.

If you ever find yourself in a situation where you need money fast to pay your taxes, our loans can help you avoid tax penalties. We offer same-day funding for those with a valid debit card on file. Apply today!

Conclusion

A side gig is often an excellent way to make some extra money. The best side gigs reward you for your time and offer you flexibility. Working for Postmates enables you to make some cash and also earn tips. You have autonomy over your schedule, and you get to choose how much time you want to dedicate.

If you don’t mind driving, this could be a great side gig for you. You just need to be 18 years or older and have a vehicle, smart phone, car insurance, and a clear driving record.

Like any job, when you earn an income, you have to pay taxes. It is as simple as that but understanding taxes can be challenging at times. I hope this piece helps clear some of your doubts and confusion and proves to be a helpful guide when tax season approaches.

If you ever find yourself in a situation where you need money fast to pay your taxes, our payday loans, installment loans and line of credit loans can help you avoid tax penalties. We offer same-day funding for those with a valid debit card on file. Apply today!