Simplify your finances and your life

Minimalism focuses on reducing the amount of clutter and distraction in your life. It allows you to pay attention to the things that you deem most valuable. You can free up time, energy, and resources to improve your health, fix relationships, work on personal growth, or focus on anything you view as important. It can also be a solution for those wondering how to get out of debt quickly.

Minimalist author, blogger, and world traveler, Colin Wright, says that “being a minimalist doesn’t mean owning nothing, it means owning exactly the right things. It’s not about being anti-consumption, it’s about being anti-compulsory consumption.” Minimalism has often been considered a type of millennial lifestyle, but people of all ages are finding aspects of it that improve their lives.

Key Takeaways

- Minimalism helps you become financially responsible

- It helps minimize clutter

- A minimalistic lifestyle can help you get out of debt fast

- Practicing minimalism can help you attain a sustainable lifestyle

Types of Minimalists

There are different types of minimalists. There are ones who live with less than 100 belongings and travel full time. There are those who choose to live in a tiny house or apartment and enjoy living with less physical clutter to maintain. There are even others that choose to incorporate minimalism into their lives by trying to utilize everything they have.

Some minimalists are committed to living a life that contributes less waste to the environment, such as Lauren Singer, who lives a zero-waste lifestyle. You don’t have to start composting, making your own beauty products from scratch, or even trying to sell your house. Unless you want to do that…

Realistically, you could just select a few values of minimalism to include in your every-day life. You may find that it can help you reduce or get out of debt, simplify your finances, and live a life with less stress.

Prioritize Your Spending

Start your minimalism journey by tracking your spending to see where your money is going. Save receipts and store them in one location. Once you’ve acquired about two months’ worth of receipts you can start reviewing them.

Take a hard look at the patterns you find in your purchases. Decide which are most important to you. Don’t make excuses for yourself or your purchases. Eliminate shopping as a way to de-stress or socialize, because you can accomplish both without having to spend money.

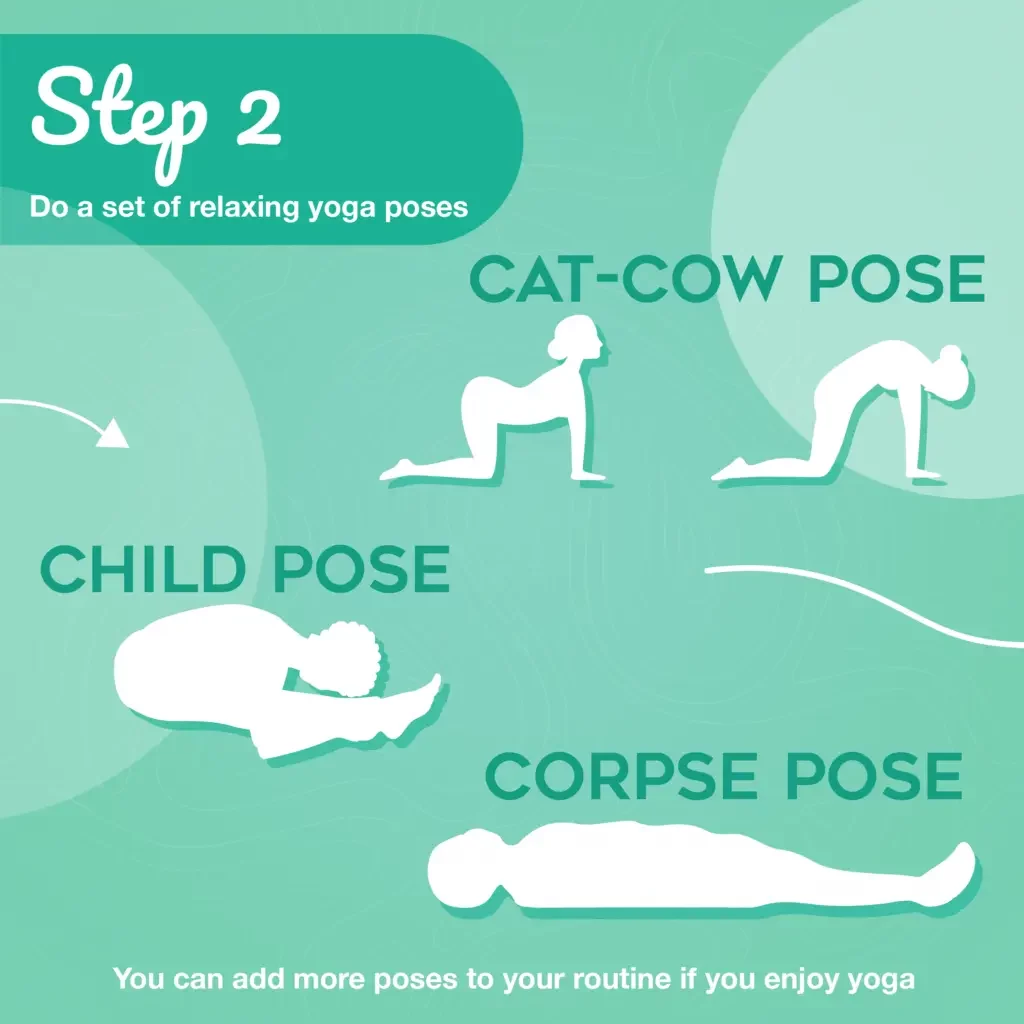

In fact, here’s one way to reduce stress without spending a cent.

For more tips on de-stressing, check out these tips:

Along with improving mental health, it’s time to get real with your finances. Create a realistic budget you can actually stick with over time.

Read our article on how to create a budget and stick to it. Once you are able to stay within your budget, you will find yourself becoming more responsible with your financial lifestyle. You can even decrease your stress by knowing that you’re living within your means.

Practice Mindfulness

Begin the process by clarifying the difference between your wants and needs. Keep a minimalist mindset about your spending habits to help you carefully decide if you really need any particular item before you purchase it. Some minimalists recommend imposing a waiting period for purchases, which are not emergency items. For example, wait 24 hours after making your grocery list, or for a purchase of up to $50. If the item you are considering purchasing is $50-$100, wait two days before making the decision. A $500 item may need a week-long waiting period, while a $1000 purchase may require a month.

Change Your Relationship to Money

Try to live below your means. Make financial decisions that line up with your personal values and beliefs, instead. Start seeing debt as a roadblock to your happiness. Realize that as you pay off the debt, your financial discontent or stress will decrease, and your sense of personal freedom will increase.

It’s wise to start focusing on your consumer debt first, such as credit card debt. Think about what you’re no longer using, but are still paying a lot of interest on, such as restaurant meals, drinks with friends, and gifts you have given away. It’s wonderful to enjoy these things, but going forward, it’s better to pay with cash. No sense in adding interest to an otherwise happy experience.

For these previous purchases, put as much money as you can afford towards paying down these consumer debts. You don’t want them to become larger than they already are. You can look forward to using your money for the experiences you want in the long run.

Take any steps you can toward simplifying your finances. You may find it’s easier to pay all of your bills on one or two specific days each month. Consolidating some of your debt so there aren’t so many different bills to juggle may be helpful. There’s many benefits to minimalism. Learning how to get out of debt is one of the key teachings this lifestyle provides.

Try to automate as many of your bills as possible, so you don’t risk forgetting to make payments and being assessed additional late fees. Some companies will even offer a small discount if you set up automated payments with them! Always look for better deals on goods and services you have to purchase, such as insurance or home and auto repairs. Remember that every dollar saved is putting you closer to financial freedom and less stress.

Decrease Your Belongings

You can be happier with less stuff! Get off the roller coaster of compulsive consumption and realize that you don’t need to rush out and purchase the latest and greatest item every time advertising and society tell you.

Most new items are unnecessary, and the only reason we tend to want a new item is because it’s bright and shiny, but that comes with a high cost. Many minimalists agree that you should use your tech items until they no longer work or are woefully out of date. That means, if the screen breaks on your phone, you should get a new screen rather than an entire phone. Many items that we choose to replace are actually fixable for a far lower price.

The KonMari Method

The KonMari Method, created by Marie Kondo, can be a useful way to begin sorting and downsizing. This method supports tidying up your environment by category, rather than location.

You would begin with clothing, then move on to books, miscellaneous items, and sentimental items. You keep only the items that “spark joy” for you and simply sell or donate the rest. If the KonMari Method doesn’t sound like something for you, it’s okay to just begin the process of downsizing in whatever way you feel is best for you.

Great rules to follow include removing items that do not add value to your life and that you have not used in the last 6 months. It’s okay to let things go. Fewer belongings equals less stress, less time spent cleaning and organizing, and less clutter in your environment.

You can make extra cash by selling the items that you no longer want. The items that you cannot sell, you can donate to your local thrift store. If you have items that aren’t sellable, but are still usable and in good quality, consider a women’s or children’s center. Oftentimes, mothers and children arrive with just the clothes they’re wearing that day.

Regardless of where you donate, you can rest assured that your items will go to use and be loved by a new person. Additionally, you can collect the donation receipts and file them at tax time to possibly get an even larger tax return. There is value in having less.If you are interested in learning more about minimalism, you can read more here.