Odds are, if you’re taking out a payday loan, you’re looking for a quick financial fix. Unfortunately, this doesn’t always mean that your money troubles go away overnight. You may find yourself in a position where you aren’t able to pay back your loan when you expected to – but what happens when you can’t make a payment? There are a few things you should know.

Payment Accessibility

Is the physical act of paying back the loan the issue? Most payday loan providers offer multiple ways to pay back the loan, such as phone, email, online, through an app, or even via text message.

At Net Pay Advance, we strive to make the process easy. We have multiple ways for you to pay back your loan. You can contact us over the phone, by email, by text, on our website, or on our app to pay back your loan. We try to provide multiple channels so that you can choose the one that works best for you.

You can click here to access your account and make a payment.

Here are five other ways to contact us and manage your account:

Phone

1-888-942-3360

Text

1-800-505-3539

Website

www.NetPayAdvance.com You can make a payment from your account by following these steps:

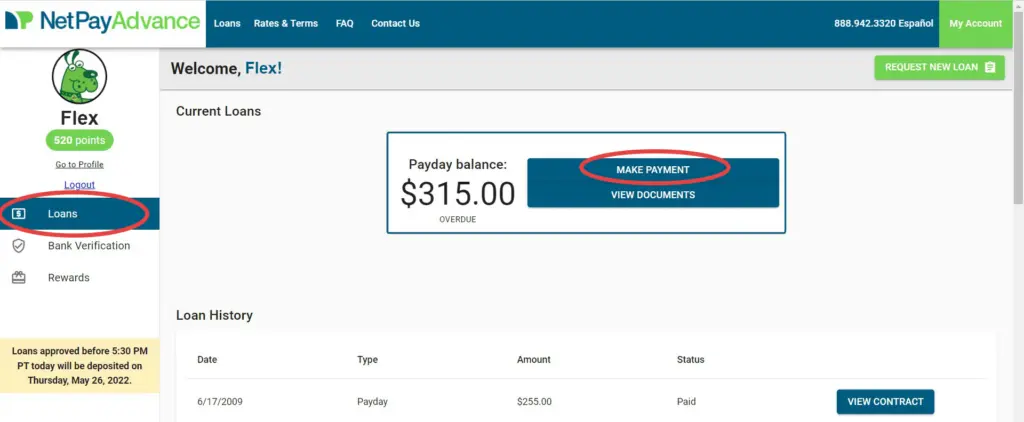

- Log into your account.

- Click on the “loans” tab.

- If you currently have a loan you need to pay, you can click “make payment.”

- A pop up will appear and you can choose the debit card you want to use to repay it.

- Click the “next” button and follow the directions.

App

You can make a payment from your app by following these steps:

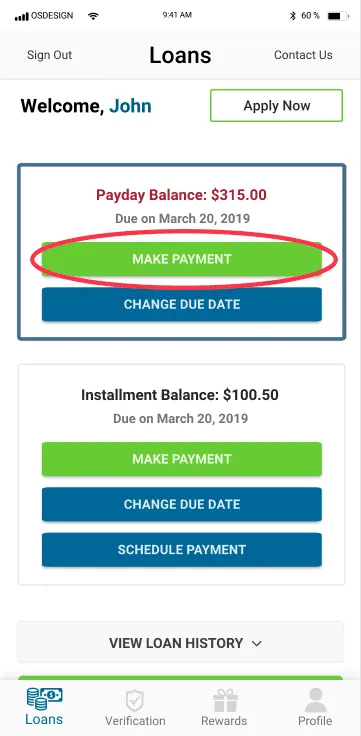

- Log into your mobile app and click the “loans” tab

- If you currently have a loan you need to pay, you can click “make payment”

- You’ll be taken to a new page

- Follow the directions

If we have ruled that out as the issue, next, we will look at the issue of not having enough cash to pay back your loan on time.

“If you are going to miss a due date, give us a call [ahead of time] so that we can see what payment plan options you might qualify for,” shares our customer service team.

See more of our suggested payday loan best practices.

We understand that you might not have the necessary funds to pay off your loan. Believe us, it happens to the best of people. We’re more than happy to help in any way we can. We need you to work with us by staying transparent and keeping us informed. Dodging the issue will not make it go away. We appreciate your honesty and cooperation as we try to seek a solution.

Before your due date

Extend Your Due Date up to 3 Days

If you know you won’t be able to make your payment before the loan comes due, some payday loan providers will offer a repayment due date extension.

At Net Pay Advance, we offer extensions up to 3 days on every loan you take out with us. Give our customer service center a call at 888-942-3320. Our representatives will gladly take care of that for you.

You can also go online to our website, www.netpayadvance.com, and log-in to your account to easily extend the loan on your own.

Here’s how to do that:

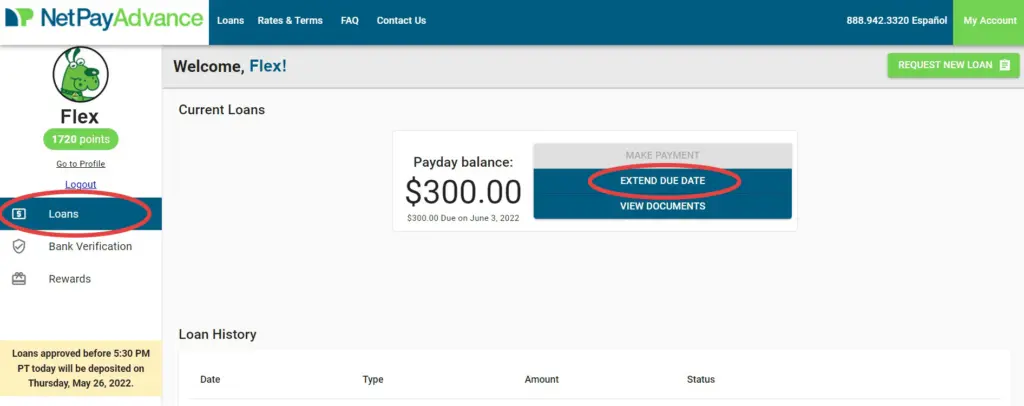

- Log into your account.

- Click on the “loans” tab.

- If you currently have a loan you need to pay, you can click “extend due date.”

- A pop up will appear.

- Follow the directions from there.

If you’d prefer to use your phone, you can extend your loan from your Net Pay Advance app. The process is similar.

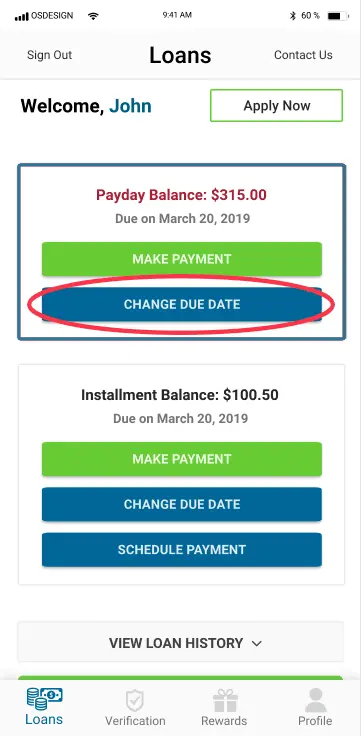

- Log into your mobile app

- Click the “loans” tab

- If you have an upcoming loan due date, you can click “change due date”

- You’ll be taken to a new page; click the down arrow

- Select your preferred due date date

Extensions Longer Than 3 Days

If you need an extension for longer than the allotted three days, you must call and speak to a representative at 888-942-3320.

Extensions longer than three days are a one-time courtesy, so be absolutely sure you’re ready to use it! Keep in mind that you will be required to sign updated contracts about your new due date.

Extended Payment Plan

Check to see if your payday loan provider offers extended payment plans.

Net Pay Advance’s customers are eligible for an extended payment plan (EPP) once every twelve months. The payment plan will allow you to pay back your loan in four equal payments. You must sign a contract saying you agree to the terms of the EPP before you can be set up for the payment plan.

Once you sign the contract, no changes can be made, so don’t sign until you fully understand your payment amounts and due dates! If a due date is missed and the EPP is broken, your account will then go to our collections department.

You can call or email our customer service center to have your EPP set up for you anytime before your due date.

On Your Due Date

Bank Withdrawals

If you don’t make an extension or you still can’t make your payment after your extension ends, payday loan providers will then attempt to collect the money from the bank account that they have on file.

Net Pay Advance will attempt to receive payment by running the debit card we have on file or sending an ACH through your bank account at approximately 8:30 AM PT.

Please note that if your debit card declines, an ACH debit will be sent at 5:00 PM PT. It takes four business days for us to receive the results of an ACH.

If no payment is received, your account will then be moved to a collections department.

Past due and collections

Once you’re in collections, a non-payment fee will be added to your balance and you will receive email and text notifications about payment not being received. Net Pay Advance will attempt to acquire payment one more time before we start actively trying to get in touch with you via phone call.

Promise-to-Pay (PTP) Plan

Our collections department can set up a promise-to-pay plan. Our payment plan that is most convenient for you so that you may pay off your balance in increments or all at once. You may also go to your account online to take care of your payment or select a payment plan.

Remember, you can re-loan once your balance has been paid in full, so it’s in your best interest to communicate with our collections team at 888-942-3360 to get your payment(s) taken care of.

Other Options if You Can’t Repay Your Loan

If you’re struggling to pay back your payday loan, you may be struggling to pay for other needs. Fortunately, there are programs available, such as:

- Community assistance programs: These plans can help with rent, utilities, or food

- Nonprofit credit counseling: Credit counselors can help advise the best course of action for your unique situation

Life happens. We know it because some of us have been there ourselves.

A lot of times financial situations are out of our control. Other times, we know the exact moment we made a financial mistake. There’s no one-size-fits all cause or solution.

We do know though that asking for help can feel uncomfortable sometimes. It shouldn’t be though. There’s no shame in asking for help. Sometimes asking for a little help is all it takes to get back up and running again.

Look for Ways to Find Fast Cash

There are a variety of ways to make fast cash. Check out these helpful guides from Net Pay Advance:

If you have any questions about your loan or if you still aren’t confident about what happens when you can’t make a payment, call 888-942-3320, use the chat feature on our website, or email [email protected] during our business hours to speak with a customer service representative.

You can always review our rates and terms. If you’d like, you can also review your loan documents by signing into your Net Pay Advance account.

There is no shame in not having the requisite funds to repay your loan. Life happens and anyone could be in your situation right now. Brushing the issue under a rug, or ignoring it, is not going to help anyone. As difficult as it might seem, we need you to know that we’re going to figure things out as long as you keep us informed. We appreciate your honesty and transparency.

Next time you need a personal loan, consider a line-of-credit loan that allows you to pay it back in installments. This may help you manage your loans a bit better.