Americans hate to talk about money. It’s right up there with other taboos, like politics and religion, that are almost universally barred from everyday conversation.

Diving into debt in casual conversation? No thank you.

There’s a time and a place for everything — just don’t talk about money. Or can you? To best understand if and when people are comfortable talking about money, one company surveyed 982 employed people who owned or rented homes. It’s time to talk about money.

It’s not all taboo, is it?

While we almost universally dislike discussing money with friends and family, not talking about money can pose its problems. These discussions can help give us peace of mind, while not having them can negatively affect our health, wealth, and happiness.

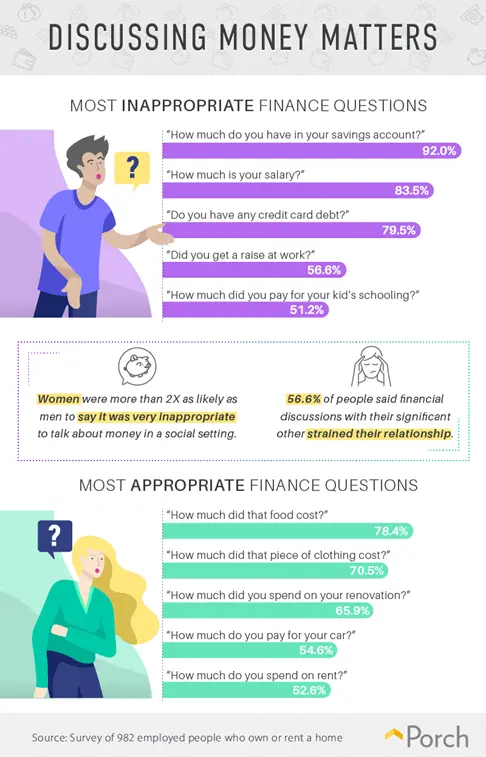

There are questions you should steer clear of. For instance, you probably shouldn’t ask an intrusive question like how much money someone has in his or her savings account. Another no-no: salary. At least 83.5% of the survey respondents thought it was inappropriate to ask about salary, and 92.5% thought it was inappropriate to discuss savings. Definitely steer clear of that one in most conversations.

What about the cost of rent or a car? People are nearly split. While 54.6% thought asking the price of a car was appropriate, 52.6% said the same about rent. How about asking how much one paid for their child’s schooling? Inappropriate, according to half of the respondents. A few that didn’t cross the line were the cost of food, clothing, and renovations.

Talking money in a relationship

Talking about money is tricky, no matter who you might be conversing with. Money is a leading cause of stress in relationships and is also one of the most cited reasons for divorce. Couples also aren’t fond of money talks. Fifty-six percent of respondents reported that money strained their relationship.

Where you’re at in your relationship often determines what financial discussions might be appropriate to bring up. While asking about tough subjects — salary, credit card and student loan debt — might be essential parts of cohabiting, sticking to easier financial questions might be best starting out.

Talking money at work

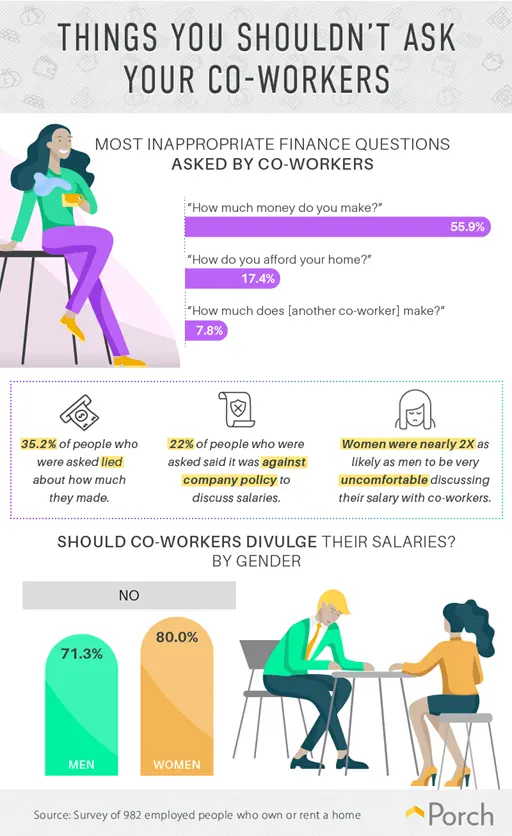

What’s your best-kept secret? Chances are it might be your salary. Discussing money with coworkers can be awkward. Some companies may even prohibit it. While talks about salary can improve the bottom line, most thought it was inappropriate to question a coworker’s salary. So, should you stay hush-hush on money in the workplace? The answer is: well, maybe.

Even when salary was brought into question, over a third of people admitted to lying about how much they brought home. Uncomfortable? You bet. Inappropriate? Respondents thought so, too. At least 71% of men thought coworkers should not tell each other their earnings. Eighty percent of women said the same. With the gender pay gap issue in America, women typically were often twice as likely to be uncomfortable sharing their salary information with coworkers.

Talking rent money with the landlord

Talking money isn’t simple, we know. Having that conversation with a close friend or family member may be easier than others — like with your landlord. The relationship between renter and landlord almost entirely revolves around money. So, are conversations about money entirely unfit for this pair?

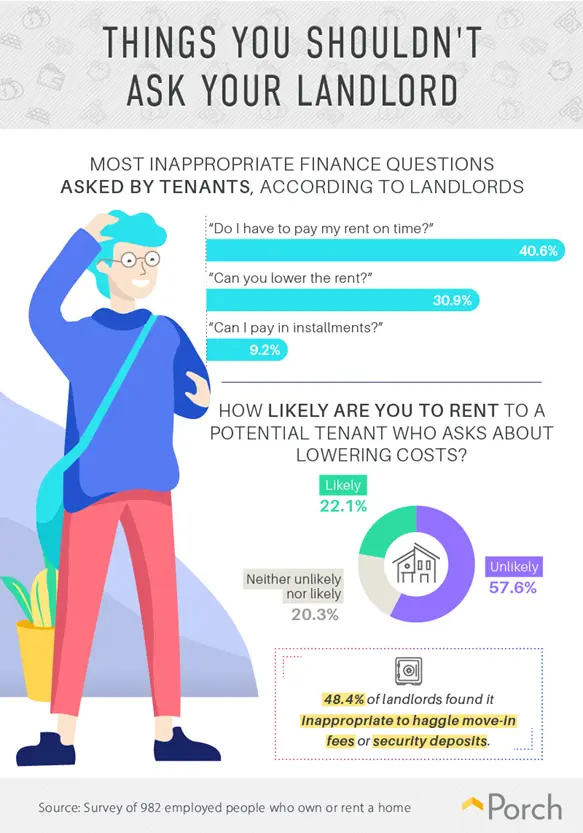

A question of if you have to pay rent on-time is typically one landlords don’t want to hear. In fact, nearly 41% of 217 landlords thought asking this question was the most inappropriate. Another 31% said asking to lower the rent was also inappropriate. If you thought about negotiating the rent rate, you might reconsider. Nearly 60% of landlords said they were unlikely to rent to a potential tenant who asked for a reduced rate. Half also told us they believed it was inappropriate to haggle move-in fees and security deposits. Is anything fair game? You might consider asking to pay in installments. Less than 10% of respondents said they believed this was inappropriate.

Answer to your financial question? Depends who’s asking

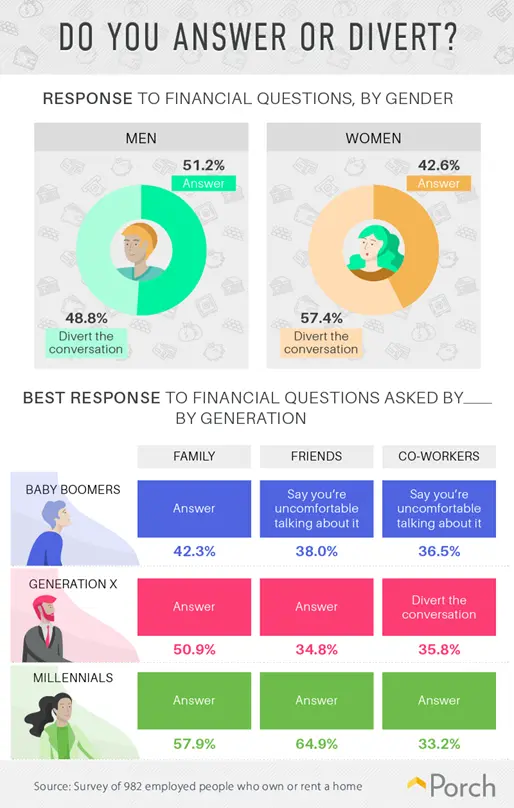

If posed a question about your finances, do you (A) answer honestly, or (B) divert the subject? A lot depends on who is asking and who is answering. More than half of men said they answer questions about their finances, while nearly 60% of women said they divert the subject.

Grouped by age, millennials were the most comfortable talking money — even on a first date. While baby boomers, Gen Xers, and millennials all said they would answer financial questions asked by a family member, only millennials said they would answer financial questions posed by both friends and coworkers.

Talking money — the right way

There’s no easy way to talk about money. Whether with friends, coworkers, or family, the discussion can be uncomfortable. All things considered, there are ways to ease what might be a difficult discussion. Trying to talk money with your coworkers or friends? Gauge the relationship first. While it might be best to squash the salary talk with a new hire or coworker you consider only an acquaintance, someone more involved in your personal life will likely be more receptive to the discussion.

Ensuring you’re equipped with the right financial acumen to hold these discussions comfortably can be a good first step moving forward. We’re with you, whether you need information on building a budget, saving money, or finding help when the unexpected happens. Sharing financial resources can help us work through money together.

Talking money isn’t easy, but it can be easier.

Information and images originally posted on Porch.com.